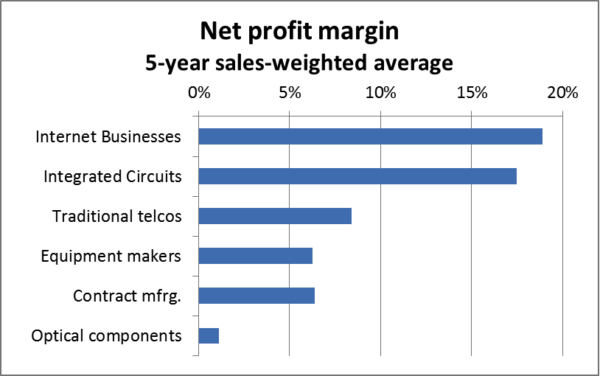

The average profitability of optical passive component and module suppliers was very close to zero over the last 5 years, despite strong demand for optics. Compared to every other level of the industry supply chain, profitability of the optical component manufacturers was the lowest by far.

Financial reports of several suppliers of optics started to show signs of improvement over the last 2-3 quarters. The average profitability of optical component and module vendors was 2% in 2015, compared to a loss of 1% in 2014. There is a good chance for reaching 5-7% profitability in 2016-2017 and setting a new record. The highest profitability achieved so far was 5.5% in 2010, preceded by more than ten years of heavy losses.

Net profit margins in the optical components value chain

Source: Public financial reports

Several component vendors restructured their businesses in 2013-2014 and these efforts are starting to pay off now. Accelink, Applied Optoelectronics, Coadna, Neophotonics and Oclaro reported significant improvements in financial performance. Acacia joined the list of publicly traded vendors recently and holds the record with a 17% net margin for 2015. Finisar’s profits started to improve in the second half of 2015 and we expect this trend to continue.

However, the average profitability is likely to stay in the single digits for a while. This industry is very competitive and it is likely to remain so for the next several years. Demanding customers, shorter product lifecycles and investments required to support development of new products are a heavy burden for suppliers. There are close to 40 vendors in the race to offer 100GbE optics to the cloud companies building mega-datacenters. Not many of these vendors will be successful in the long term, but they will continue to put pressure on the profitability of larger publicly traded companies in the industry.

Many start-up companies, betting their future on supplying high-speed optics to cloud vendors, develop products based on silicon photonics and expect that this new technology will give them a sustainable cost advantage. LightCounting’s report on Integrated Optical Devices offers detailed analysis of the opportunities for silicon photonics technology, and recognizes the potential advantages of this technology. However, we expect that a majority of high-speed Ethernet optics used in mega-datacenters will still be based on more established InP and GaAs based optics even in 2021.

Despite all the risks, developing new manufacturing technologies offers a path to sustainable competitive advantage and long-term profitability. Silicon photonics holds a promise for being such a technology. High-valued acquisitions of silicon photonics companies and the recent IPO of Acacia offered much needed success stories for investors. However, the risk remains high. Many other vendors, starting just to ship silicon photonics based products now, will have to prove themselves in 2016-2018.

DK Photonics – www.dkphotonics.com specializes in designing and manufacturing of high quality optical passive components mainly for telecommunication, fiber sensor and fiber laser applications,such as 1064nm High Power Isolator,1064nm Components, PM Components, (2+1)x1 Pump Combiner,Pump Laser Protector,Mini-size CWDM,100GHz DWDM,Optical Circulator,PM Circulator,PM Isolator,Fused Coupler,Mini Size Fused WDM.

No comments:

Post a Comment